What is a Confirmation Statement and Why does it need to be filed?

£11.99 Confirmation Statement / Annual Return Filing Service - Cheapest Service in the UK. Fast service. Know more here.

Filing confirmation statements can be confusing and complicated for someone who does not have the relevant expertise and knowledge.

Introduced by the UK government in June 2016 as a replacement for the filing of the annual return AR01 form, a confirmation statement must be delivered to Companies House at least once every 12 months, even if the business is dormant.

In this article, we will explore what a confirmation statement is, its purpose, and when you are supposed to file it.

What is a confirmation statement?

A Confirmation Statement is a document that all Limited Companies and LLPs must submit to Companies House at least once every 12 months.

It is a simple way of informing Companies House that the business details that Companies House holds for your business are up to date.

It also verifies that important company data recorded at Companies House is still accurate at a certain date.

Is the confirmation statement the same as the annual accounts?

A confirmation statement and annual accounts are not the same. An annual account is a document that shows the financial performance and activity of a company over the previous year.

While a confirmation statement shows key details about the internal structure of a limited company.

Annual accounts must be filed within nine months after your accounting reference date while confirmation statements need to be filed annually within 14 days of the end of your confirmation period.

Both documents must be filed at least once a year and the director is responsible for filing the statutory documents.

What information needs to be confirmed in a confirmation statement?

While filling a Confirmation Statement you need to check and confirm that the information provided to Companies House for your business is accurate or not. A Confirmation Statement primarily consists of details for your limited company such as;

- · Registered Office Address

- · Standard Industrial Classification (SIC) codes (business activities)

- · Statement of capital

- · Trading status of shares

- · Shareholder information

- · Exemption from keeping a PSC register

With the new changes taking place at Companies House, companies must provide a registered email address for official communication. According to the registrar, the email address will not be published on the public register.

Existing companies will need to provide an email address when they file for their next confirmation statement that is dated 5th March 2024 onwards while new companies will need to do so when they incorporate.

The email address will be used by Companies House to communicate with you about your company, so you must choose an appropriate email address. It is possible to register the same email address for more than one company. You can change your registered email address through the ‘update a registered email address’ service.

How to file a confirmation statement?

A Confirmation Statement can be filed online using Companies House web-filling service. You need to be registered for online filling to file your confirmation statement.

Icon Offices offer affordable, quick, and accurate confirmation statement filing services. We can file your Confirmation Statement for only £45.99 inclusive of VAT and Companies House fee. Click here for more information and to proceed.

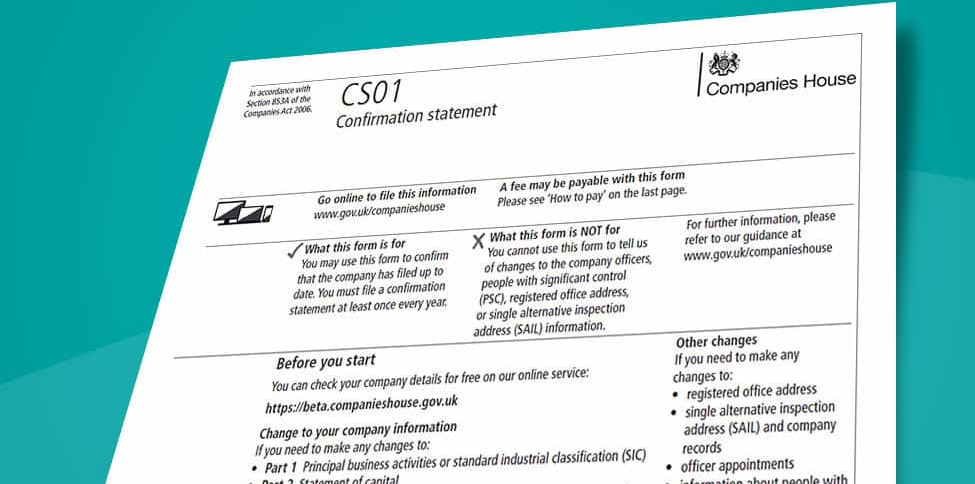

Alternatively, a Confirmation Statement can be filed offline using paper form CS01. You will need to post the completed CS01 form to Companies House.

The fee for submitting your Confirmation Statement via a paper form is £62. You can make cheques or postal orders payable to Companies House.

We can also assist you with offline filling. For more information reach out to us at info@iconoffices.co.uk

When do I need to file a confirmation statement?

A confirmation Statement needs to be filed every year within 2 weeks (approximately) of the anniversary of the approximate incorporation date of the company.

The 12-month period starts on either your company formation date or the date you filed your last confirmation statement.

For example, if you formed your company on 4 June 2024, your 12-month review period will start on 4 June 2024 and will end on 3 June 2025.

The filling date for your confirmation statement will be 3 June 2025 and the filing deadline is 14 days later, which will be 17 June 2025.

The exact window for filing and deadline can be seen on Companies House website. You can also sign up for email reminders from Companies House to ensure that your confirmation statements are filed on time.

Can I make changes to my company details whilst filing my confirmation statement?

You can update certain details of your company during the Confirmation Statement filing process. These changes includes:

- · Standard Industrial Classification (SIC) codes

- · Trading status of shares

- · Shareholder information

- · Statement of capital

- · Exemption from having to keep a register of People with Significant Control

All other changes such as changes in officers’ details, registered office address, company name, etc. have to be filed separately using the relevant processes before or at the same time as filling your confirmation statement.

Do I need to file a Confirmation Statement if my company is dormant?

You must submit a Confirmation Statement to Companies House every 12 months, even if your company is dormant or it is a non-trading company.

This confirms to Companies House that the details they hold for your company are up to date.

Do I need to file a Confirmation Statement before closing my company?

As per Companies House guidelines you should file any outstanding Confirmation Statements even if you are applying to close your company or have already applied to close it. This will ensure that the information Companies House holds for your company is accurate before its closure and it also protects you from any repercussions from Companies House later.

What will happen if I do not file a confirmation statement?

Every company, including dormant and non-trading companies, must file a Confirmation Statement once every 12 months.

Not filing your Confirmation statement is a criminal offense and directors or LLP designated members could be prosecuted.

There is no penalty for filing your Confirmation Statement late. However, Companies House could take steps to strike off your company, which may result in your company being struck off the register and dissolved.

Failure to deliver a confirmation statement is a criminal offense and can have serious consequences for a company and its officers.

Who is responsible for filing a confirmation statement?

Directors are responsible for filing the confirmation statement with Companies House. They are to make sure that the confirmation statement is filed before the deadline.

The responsibility can also be delegated to a company secretary. In an LLP, designated members are responsible for filing confirmation statements.

Remember, filing a confirmation statement is a must, failure to which the registrar may take steps to strike off the company or LLP and disqualify or prosecute the directors or designated members.

Need to file your confirmation statements? Not to worry. Icon Offices can help you file confirmation statements quickly and accurately. If you have missing documents or codes from Companies House we can even help you get them at no additional cost. For more information, contact us at info@iconoffices.co.uk